The financial sector undergoes a constant demand to optimize efficiency, particularly when it comes to debt recovery. Classic methods typically turn out to be time-consuming and expensive. However, the emergence of AI automation offers a groundbreaking solution to streamline this crucial process.

- AI-powered platforms can process vast amounts of data to identify high-risk borrowers and predict potential delinquencies.

- Streamlined debt collection workflows can reduce manual intervention, freeing up staff for more strategic tasks.

- AI-driven virtual assistants can communicate with borrowers in a customized manner, providing answers and facilitating payment arrangements.

By leveraging the power of AI automation, financial institutions can achieve significant improvements in debt recovery. These include boosted efficiency, reduced costs, improved customer satisfaction, and ultimately, a solid bottom line.

Innovative AI Approaches to Debt Recovery

The debt collection industry is embracing a dramatic transformation with the adoption of intelligent intelligence (AI)-powered solutions. These advanced technologies are modernizing traditional strategies by optimizing efficiency, precision, and AI in debt collection debtor interaction. AI-driven platforms can analyze vast datasets to predict risk of default and tailor collection approaches for optimal success.

- Moreover, AI-powered chatbots can offer prompt help to debtors, answering common inquiries and lowering the workload on human agents.

- Therefore, AI-driven debt collection solutions can help creditors realize improved debt resolution.

Elevating Collections: The Power of AI

Artificial intelligence is transforming the way we manage and utilize collections. From streamlining tedious tasks to revealing hidden patterns, AI-powered tools facilitate collectors to maximize efficiency.

Additionally, AI can customize the collecting experience by providing personalized recommendations.

- Harnessing machine learning algorithms, AI can analyze vast amounts of data to estimate future trends and locate rare or valuable items.

- As a result, collectors can make more informed decisions.

- Furthermore, AI-powered tools can improve the security and preservation of valuable collections.

Next-Gen Contact Center: Automating Debt Collections

The arena of debt collection is rapidly evolving. Traditionally a labor-intensive process, it's now increasingly adopting intelligent contact center technologies to streamline operations and improve results. Automation plays a key role in this transformation, enabling businesses to process debt collections with greater precision.

Intelligent virtual assistants (IVAs) are at the center of this revolution. These advanced AI-powered systems can converse with debtors, collect information, and efficiently mediate simple inquiries. This not only frees up human agents to focus on difficult cases but also enhances the overall debtor interaction.

- Furthermore, intelligent contact centers leverage data analytics to recognize trends and forecast potential challenges. This preventive approach allows businesses to intervene early on, reducing the risk of late payments and enhancing their debt collection performance.

The Future of Debt Collection is Here: AI Driven Insights

The sphere of debt collection is rapidly evolving, fueled by the emergence of cutting-edge artificial intelligence (AI). Advanced AI algorithms are transforming the way debt recovery is handled.

These sophisticated systems can process vast amounts of data, identifying valuable insights that empower collectors to make more informed decisions.

- Significant benefit of AI-driven debt collection is the ability to customize communication with debtors.

- AI can analyze debtor data to understand their circumstantial standing, allowing collectors to develop more targeted communications.

- Moreover, AI can optimize many routine tasks, freeing up collectors to focus on more complex interactions.

Optimizing Collections Performance with AI Technology

Streamlining through the collection process has always been a top priority for businesses. Traditionally, this involved manual methods, often time-consuming. However, the advent of AI technology is revolutionizing the way we collect by providing unprecedented opportunities.

AI-powered tools can process vast amounts of data to pinpoint patterns and trends, enabling more precise collection efforts. Furthermore, AI algorithms can automate repetitive tasks, enabling human resources to focus on more complex activities.

The benefits of integrating AI into collections strategies are numerous. Businesses can expect increased collection efficiency, reduced costs, and enhanced customer relations.

- Harnessing AI for collections provides businesses with a significant operational advantage in the ever-evolving market landscape.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Katie Holmes Then & Now!

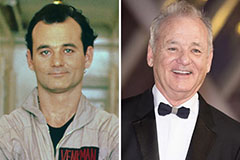

Katie Holmes Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!